utah county food sales tax

Weber County Sales Tax. The Utah County Sales Tax is 08.

The Utah County sales tax rate is.

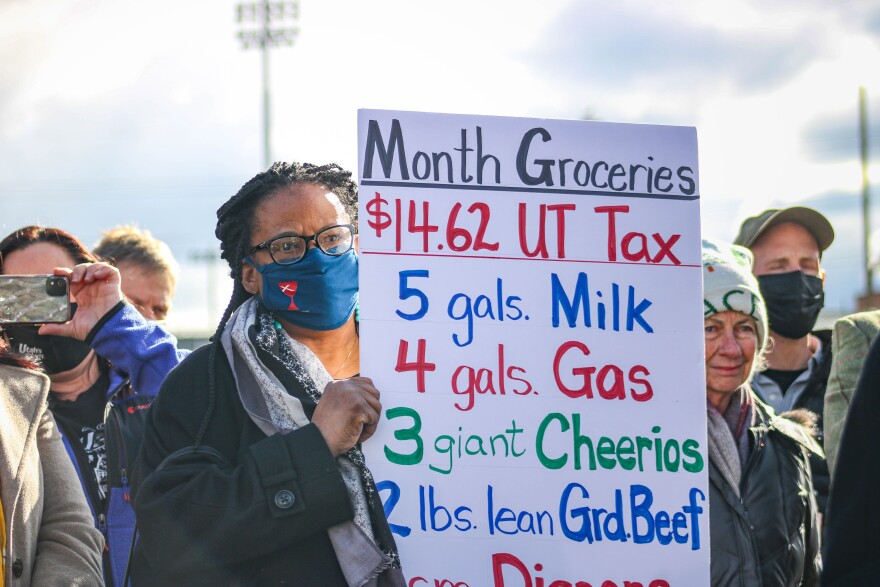

. Utah county food sales tax Sunday March 20 2022 Edit. The following documents give cross-listings of Utahs cities towns counties and entity codes for sales and use tax purposes. Based off of Utahs current sales tax rate on unprepared food of 175 Berni probably pays around 1925 a month in sales tax on food.

The minimum combined 2022 sales tax rate for Salt Lake City Utah is. Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 42. 2022 Utah state sales tax.

Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. There are a total of 131 local tax jurisdictions across the.

See taxutahgovsalesrates for current. With local taxes the total sales tax rate. The 2018 United States Supreme Court decision in South Dakota v.

Restaurants that sell grocery food in addition to prepared food may collect the lower 3 percent tax on their grocery food sales but ONLY IF those items are listed separately on the receipt or invoice. Counties may adopt this tax to support tourism recreation cultural convention or airport facilities within their jurisdiction. 100 East Center Street Suite 1200 Provo Utah 84606 Phone.

This is the total of state county and city sales tax rates. Has impacted many state nexus laws and sales tax collection requirements. It is assessed in addition to sales and use taxes on sales of food prepared for immediate consumption by.

This means that depending on your location within Utah the total tax you pay can be significantly higher than the 485 state sales tax. A county-wide sales tax rate of 08 is applicable to localities in Utah County in addition to the 485 Utah sales tax. Washington County Sales Tax.

In the state of Utah the foods are subject to local taxes. If a locality within a county is not listed with a separate rate use the county rate. The state sales tax rate in Utah is 4850.

Restaurants must also collect a 1. Utah sales tax sales taxes are applied to a variety of goods including tangible personal property transportation services hotels and food. Cottage Food Production.

Utah County Sales Tax. Monday - Friday 800 am - 500 pm. Used by the county that imposed the tax.

See Pub 25 Sales and Use Tax for more information. 6 rows The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax. Exact tax amount may vary for different items.

Click on any county for detailed sales tax rates or see a full list of Utah counties here. Wasatch County Sales Tax. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Rebecca Nielsen Program Manager. With the rate restored to the full 485 Berni will likely spend around 5335 in state sales tax a month or about 3410 more. Both food and food ingredients will be taxed at a reduced rate of 175.

Utah has a 485 statewide sales tax rate but also has 131 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2108 on top of the state tax. As currently drafted SB59 would drop Utahs income tax rate from 495 to 485. However in a bundled transaction which involves both food food ingredients and any other taxable items of tangible personal property the rate will be 465.

The utah sales tax rate is currently. This is the total of state county and city sales tax rates. The Utah sales tax rate is currently.

You may use the. 91 rows This page lists the various sales use tax rates effective throughout Utah. Report and pay sales tax electronically on Taxpayer Access Point TAP at taputahgov using the template for form TC-62M Sales and Use Tax Return.

The County sales tax rate is. Or to break it down further grocery items are taxable in Utah but taxed at a reduced state sales tax rate of 175. Back to Utah Sales Tax Handbook Top.

Some cities and local governments in Utah County collect additional local sales taxes which can be as high as 16. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. The Utah state sales tax rate is currently.

Grocery food does not include alcoholic beverages or tobacco. Thats about 409 in state sales taxes more a year equalling about 640 a. Lowest sales tax 61 Highest sales tax.

274 rows 2022 List of Utah Local Sales Tax Rates. Wayne County Sales Tax. The Salt Lake City sales tax rate is.

The tax on grocery food is 3 percent. These transactions are also subject to local option and county option sales tax and that results in a total combined rate on grocery food of 3 throughout the state of Utah. Uintah County Sales Tax.

2021 utah state sales tax. 111 s university ave provo utah 84601 main phone. Grocery food is food sold for ingestion or chewing by humans and consumed for taste or nutrition.

You collect tax at the grocery food rate 3 percent on the grocery food and the combined sales tax rate at your location for the clothing.

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer

How Do State And Local Sales Taxes Work Tax Policy Center

Florida Taxes Florida County Map Map Of Florida Map Of Florida Beaches

How To Register For A Sales Tax Permit Taxjar

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

States With Highest And Lowest Sales Tax Rates

Utah Sales Tax Small Business Guide Truic

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Mapsontheweb Infographic Map Map Sales Tax

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Sales Tax On Grocery Items Taxjar

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)